Posted: October 21, 2025 | by: Thomas F. McKeon, CFA

Is the long-term disparity in performance about to mean-revert? Time will tell, but ignoring the relentless rules of humble arithmetic never ends well for investors.

We admit to having a valuation bias as investment professionals. That simply means we don’t like to pay high prices for stocks that are currently growing revenues at a rate higher than the broad market. We prefer lower sensible valuations for solid, profitable steady growers. Thus the equity universe tends to get split into “growth” and “value” silos.

The question for investors is thus reduced to this: will future growth justify today’s valuation for the growth stocks? For value stocks the question is: does today’s low valuation reflect poor prospects for the company or is it just an overly pessimistic short-term sentiment that will unwind and deliver superior returns as it does?

As the equity markets have been rallying almost non-stop since 2009, we have been slowly tilting our client portfolios towards the slow and steady “value” stocks. These market exposures bring a lot to the party. Lower valuations means less downside, and generally higher dividend yields. Conversely, paying too much for growth that does not materialize is a sure way to earn inferior returns.

In early 2021—as the pandemic and work-life disruptions began—millions of novice investors now working from home took to the internet, opened brokerage accounts and began trading. It seems that the bulk of their investments went into names that internet-friendly consumers were familiar with: Amazon, Netflix, Apple, Alphabet, and the like. These names are the high priced darlings of the “growth” side of the equity universe. In 2020, their valuations became even more extreme.

Despite already extended valuations and the nerve-rattling market selloff of 1Q-2020, the tech-heavy NASDAQ 100 gained more than 45% in 2020 while the broad-market S&P 500 gained 18.0% and the tortoise “value” stocks gained a meager (by comparison) 6.0%. See chart below.

The valuation disparity between growth and value stocks even prompted several research papers from prominent practitioners in late 2020 and early 2021. Their conclusion: growth stocks have outperformed value stocks for an extended period and that is unlikely to continue. We concur.

And if that conclusion is correct, the risk-reward ratio in growth stocks is currently unfavorable while it is far better in value stocks. As such, the markets present us with an opportunity—to continue and extend our portfolio bias towards value stocks. This should afford our portfolios the opportunity to earn equity returns—or better—as markets mean revert, while avoiding a potential sharp selloff of growth names.

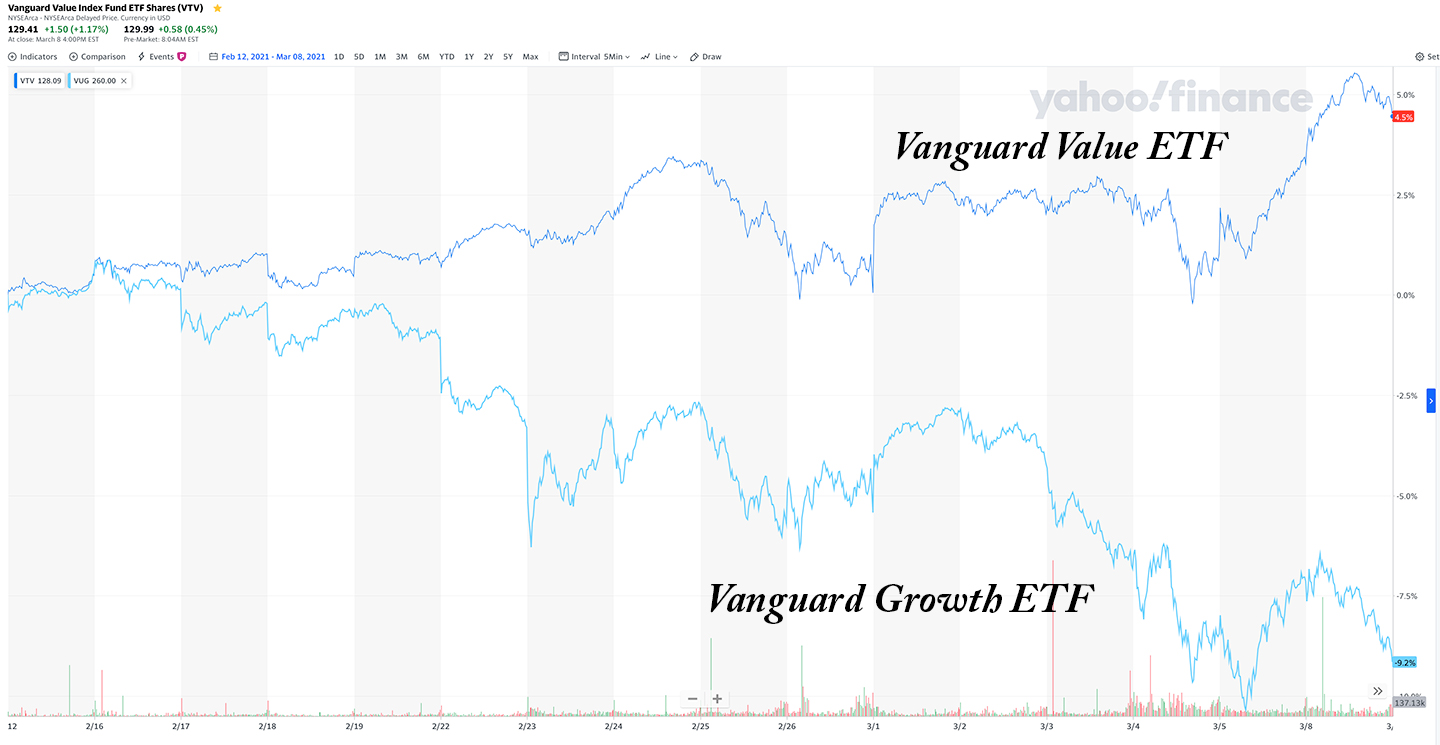

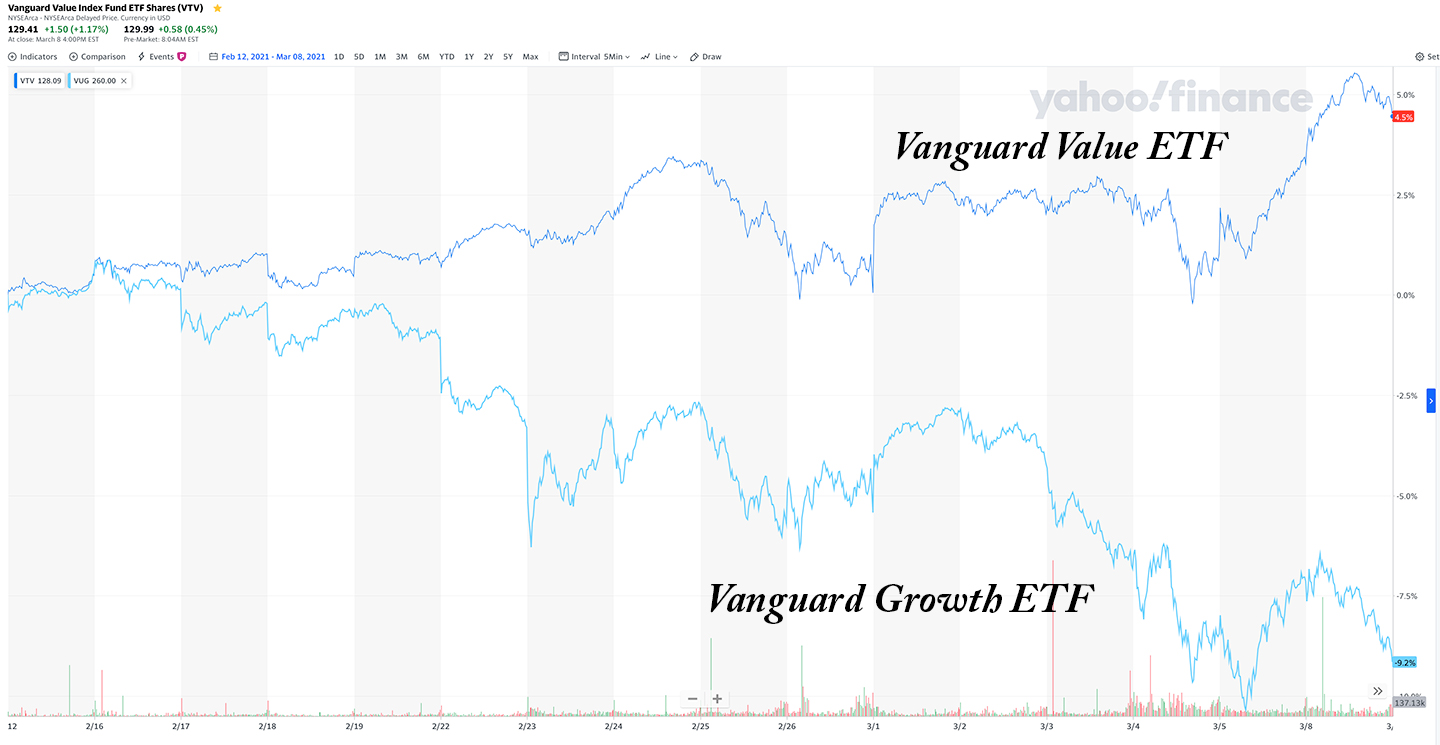

In fact this mean reversion—which is long overdue—may have begun already. The inflection point appears to be Feb12, 2021. From that date, the Vanguard Value ETF (VTV) has gained 4.5% while the Vanguard Growth ETF (VUG) has declined by 6.8% through the close on March 8th.

Is this the pivotal and long-awaited unwind? Hard to say and too soon to tell. As a wise economist said so long ago: “the market can remain irrational longer than you can remain solvent.” Still, as professionals and fiduciaries, we have to allocate prudently and that means following the data, evidence and percentages. For now, that means a significant bias towards the so-called “tortoise” stocks with steady growth, healthy dividends and relatively low valuations.

Coming Soon...