Posted: October 21, 2025 | by: Thomas F. McKeon, CFA

With apologies to Jack Bogle, if ever there was a period that proved the benefit of a global asset allocation, the first half of 2017 was that period.

Home-Country Bias is Sub-Optimal

We are big fans of Vanguard and their venerable founder Jack Bogle, who is still active in thought leadership in the investment business. We saw him speak recently at the CFA Institute Global Conference in Philadelphia. When asked a question about investing in global equities, Bogle hewed to his long-standing belief that investing in US multinationals (like Coca-Cola or Procter & Gamble) will provide all the foreign equity exposure an investor could desire.

On this issue, Bogle is missing the point. US multinationals may indeed get much or most of their revenues outside the US, but their shares are traded in the US, in US dollars and thus their share prices move like US stock market indexes.

Investment Theory and Best Practices Evolve Constantly

The way to optimize an asset allocation is to include market exposures that are not perfectly correlated and do not move in lock-step with each other. It is a given that any allocation should also have a return history to examine and draw inferences from. It should also have a compelling expected return based on current valuations of the asset class and well-founded growth and earning forecasts. Investing directly in equity markets outside the US will provide exposure to other economies, currencies and growth potential.

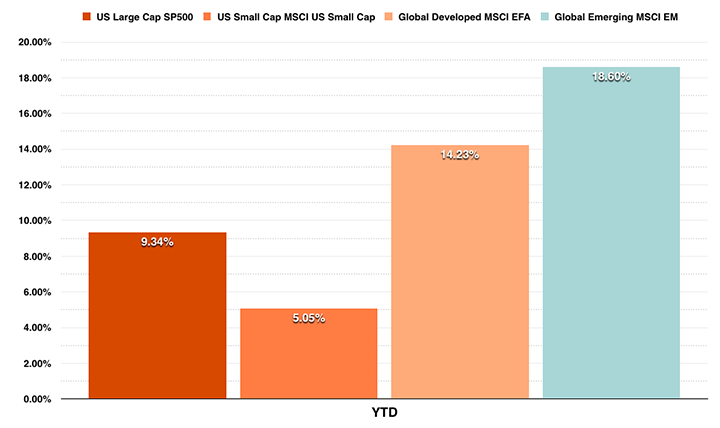

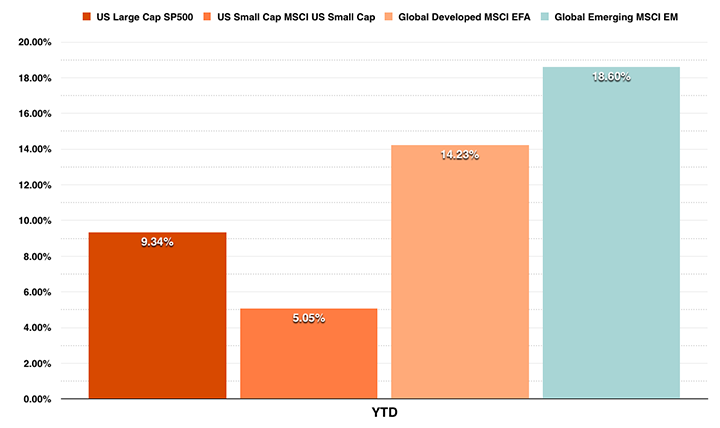

The global equity market returns from the first half of 2017 bears out this simple reality.

The bellwether US equity benchmark—the S&P 500—gained a healthy 9.34% for the first six months of 2017. The MSCI US Small Cap equity benchmark barely crested 5.0%, just over half the S&P 500 return. That contrasts with the MSCI Developed Markets index return of 14.23% and the MSCI Emerging Markets index of 18.60%. See chart below.

Any asset allocation that included exposures to Developed and Emerging markets over this period benefitted handsomely. It is impossible to make an argument that exposure to US multinationals—through the S&P 500—is all the global equity exposure a well-allocated portfolio requires.

Legacy Business Models an Endangered Species

We are aware that many of our investment advisory brethren—especially the wealth managers—still ply an investment management style that echoes Bogle’s belief: that large US stocks are all the equity exposure an investor needs. Moreover, their methodology still emphasizes stock-picking in an effort to generate performance above the benchmark, or worse yet, hiring managers (through mutual funds) who attempt to out-perform.

Despite reams of evidence that these active management pursuits are fruitless and even counter-productive, many advisors-wealth managers still thrive despite their outmoded investment services.

A long time ago in a galaxy far, far away we too were active analysts and stock pickers, managing portfolios of large US companies and trying to beat our benchmark. Like all active managers, sometimes we did, and sometimes we didn’t. But if we beat our benchmark by a slim 1% or 2%, we were doing great for our clients. But that took loads of company research, and managing portfolios of 40 to 70 stocks—a significant workload.

Contrast that with the decision to make an allocation to Emerging Markets at the beginning of 2017. The 18.6% Emerging Market return in 1H-2017 was double the S&P 500 return— a full 9.3% ahead. The active manager that can consistently and legally beat his benchmark by 9.3% does not exist. The allocation decision overwhelms any possible excess returns of that active management can deliver.

This is not an argument that the Emerging Markets index will always outperform US large company stocks: it will not. But that is the point of asset allocation.

Which brings us back to Bogle and the numerous investment advisors and wealth managers who continue to ply their home-country biased legacy investment portfolios. With so many global market exposures now available, and accessible at such low costs, how do they continue to retain clients while delivering demonstrably sub-optimal, inefficient and expensive portfolios?

Vanguard Understands What Bogle Does Not

Even Vanguard—the firm founded by Bogle—offers numerous global developed and emerging market funds across stock, bond and real estate asset classes. Regardless of what Bogle himself believes, the firm he created surely understands the benefits of and demand for global market exposures. How long can the legacy wealth advisory models retain their clients with a sub-optimal product? That remains to be seen.

If you have any questions about your allocation or how your allocation could be optimized, send us a note.

Coming Soon...