Posted: November 17, 2015 | by: Thomas F. McKeon, CFA

The CSCM structurALPHA US Large Cap provided a robust 530 basis points of risk mitigation in a very rough 3Q-2015 for equities.

Tweet

Tweet

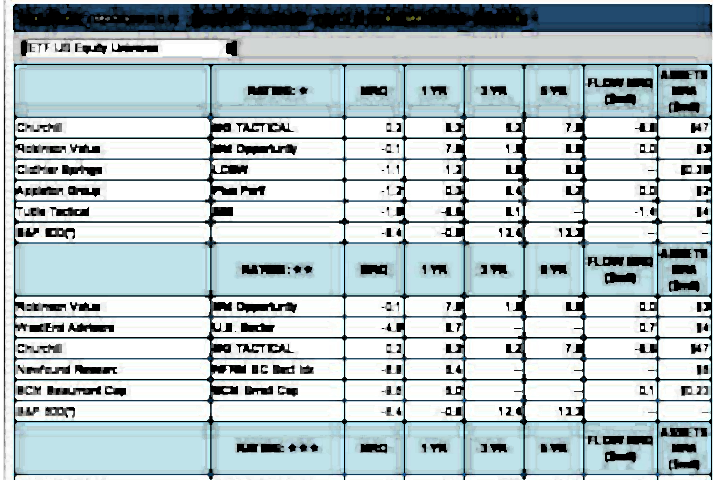

Informa Investment Solutions informed us today that our structurALPHA US Large Cap hedged strategy made their Top Guns One-Star rating for 3Q-2015 in the Managed ETF US Equity Universe. Doing exactly what a buy-write should do in a down market, the hedge provided 530 basis points of excess return over the long-only S&P 500.

After a six-year equity market rally where the S&P 500 delivered total annual returns almost twice their historical average, the market have given investors next to nothing so far in 2015. It may be like this for a while. Gurus and sages from all corners of the investment world are urging investors to temper their expectations for equity returns. We agree. Selling your uncertain upside for a certain cash flow each month may be the optimal equity strategy for a long time. That is where buy-writes generally and our strategies specifically come in.

Standing alongside traditional long-only equity exposures, our low-cost, liquid and transparent hedged strategies offer investors the opportunity to earn equity returns in low-return market environments.

Click here to see more about the structurALPHA Strategies: strategies with a structural advantage.

Click here to see the Informa Investment Solutions TopGuns Ratings. Requires Login