Posted: December 2, 2016 | by: Thomas F. McKeon, CFA

Returns in the aftermath of the election and some heavy hitters (Bogle, Ellis, Buffet) expound on the virtues of index investing.

Tweet

Tweet

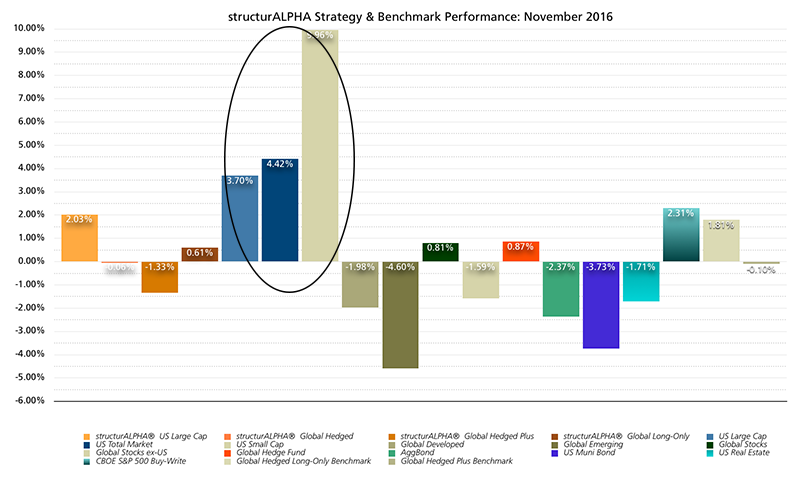

The interminable election season came to an end in early November with Donald Trump as the surprise victor. After a panicky 5.0% sell-off of the S&P 500 futures on election evening, the U.S. equity markets rallied strongly through the end of November. U.S. small caps gained almost 10% for the month—a gaudy and unsustainable trajectory.

They were the only ones at the party. The rest of the global asset complex did not share in the jubilation. U.S. bonds (of all varieties), U.S. real estate, U.S. preferred stocks, global stocks global bonds and global real estate all trended lower for the month. See the chart below.

The conventional wisdom has it that Trump will deliver double the recent growth of the GNP, thereby driving corporate profits, the markets, and putting upward pressure on rates and inflation. Time will tell. Despite the emotional reaction and the dislocation of certain asset classes—U.S. municipal bonds in particular—the president cannot simply decree a more robust economy. Lowering tax rates will not drive demand across the broad swaths of the population that does not have adequate discretionary income. Until the incomes of millions of Americans whose incomes have stagnated for decades improves, the U.S. economy will continue to be constrained.

One month is not an investment time horizon. What was true in October is still true today…with some additional opportunity to be captured by the reaction to the election—which we have used to do some strategic re-balancing and re-positioning.

We’re in the Middle of a Revolution: $1 billion a day

No not a political revolution, but the Indexing Revolution. Bloomberg Markets magazine recently published an interview with Jack Bogle, founder of the Vanguard Fund Family and inventor of the index fund. Industry wide return data continues to show that paying for active portfolio management is a losing proposition. And the most pernicious variant of active management—hedge funds—is practically criminal.

Vanguard now manages $3.5 trillion in client assets in their ultra low-cost mutual and exchange traded fund complex. Bogle reports that through 2016, Vanguard has taken in $1 billion in new client money every day. Increasingly, clients and advisors are getting the advocacy religion and turning to low-cost, market capture mutual and exchange traded fund portfolios. It is the optimal way to organize a fiduciary investment program.

This has of course caused severe pain across the world of actively managed funds and hedge funds as asset flows have slowed or even reversed sharply. The hedged fund complex in particular is suffering enormous outflows. (See “The Beginning of the End of hedge Funds” below). You can now see fund companies advertising “High Conviction” investing, “Time to Get Active” and others. It may only delay the inevitable for them.

Read the Interview with Jack Bogle Here…..

The Index Revolution: Charley Ellis

Veteran investment industry sage Charles Ellis has published a book (The Index Revolution) on the advantages of low-cost, passive index investing and why investors should see the light and join the party. Ellis, famous for publishing “The Loser’s Game” weighs in on the power of low-cost market capture index investing and why investors of all types should favor these investment vehicles. From the article:

“You don’t need to read Ellis' books to understand the writing on the wall; the evidence of the superiority of passive strategies for the average investor over the long haul has never been clearer. S&P Dow Jones Indices, which does a semi-annual scorecard tracking the consistency of top-performing mutual funds, reports that very few equity funds consistently stay at the top, especially after five or more years.”

He is interviewed in Wealth Management Magazine. Interesting that both Bogle and Ellis use the word Revolution.

Read the interview with Charley Ellis Here….

Warren Buffet on Indexing

Long a proponent of index investing, the Oracle of Omaha Warren Buffet expounds on the virtues of low-cost, market capture investing in this article from Wealth Management magazine.

The most well-known investor on the planet agrees that capturing market returns with low-cost index funds is the way to go.

Read the interview with Buffet Here….

The Beginning of the End of Hedge Funds

Diana Britton poses the question in a Wealth Management magazine article:

“Two-thirds of hedge funds fail within three years of launch. The ones that remain are expensive, opaque and have spotty performance. Are HNW investors wising up to the hedge fund folly?”

She goes on to outline the existential crisis confronting hedge funds. For our part, we say the demise of the hedge fund complex can’t come soon enough.

Facts, Conclusions and Biases

Anyone in business is challenged to see things for what they are (and should be, or might be) and organize their activities accordingly. At Clothier Springs Capital Management, we have organized our investment services around building low-cost, liquid, transparent and hedged strategies. Our aim is to deliver clients the best net return with tolerable risk. We are the antithesis of a hedge fund.

The hedge fund business is sustained by any number of biases, blind spots and inaccurate conclusions drawn from incontrovertible facts. It is sustained by legions of managers, analysts, and vendors who earn a living from the client folly and a whole infrastructure erected by clients to evaluate and allocate to the funds. This won’t be dismantled overnight. But the hedge fund proposition cannot long endure.

We will close with two of our favorite quotes that help explain why the hedge fund folly persists. We are sure you get our drift.

“It is difficult to get a man to understand something, when his salary depends on his not understanding it.”

Upton Sinclair

About a boy who sees a man and woman go into his father’s barn and shed their clothes. He tells his dad….”Pa, they’re going to pee on our hay.” Whereupon his dad says,

“Son, you got the facts straight but drew the absolute wrong conclusion.”

Attributed to Abraham Lincoln