Posted: July 30, 2020 | by: Thomas F. McKeon, CFA

Being in quarantine has provided all of us some time for reflection, introspection, baking and garage cleaning. We return to some of the recurring themes we observe and continue to rail against.

Tweet

Tweet

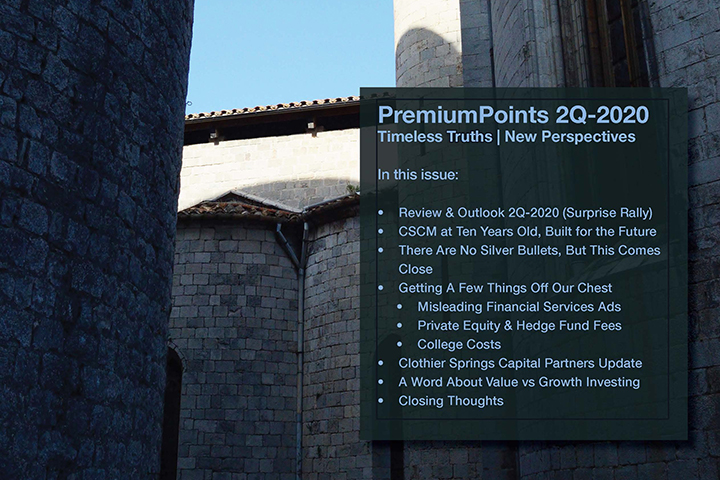

After setting a near-term low on March 23—the pandemic market panic—the global equity markets rallied strongly through the second quarter. This despite the severe economic distress as a result of pandemic related business shutdowns and in the U.S., increasing cases of Covid-19 and related deaths. If ever there was a period when the folly of trying to figure out how markets would behave in the short-term—and then trying to make productive portfolio decisions around that—2Q-2020 was that quarter. The S&P 500 had its best 2Q since 1957 with a 19.9% return.

Read More.....

Our application to be a Registered Investment Advisor was approved by the regulatory authorities on 6/30/2010. That makes us now ten years old. For perspective, the State Street S&P 500 ETF (SPY) closed at 102.20 on that date.

Read More.....

The single most important decision an investor has to make is how much risk—how large a portfolio drawdown—can he tolerate over the long-term, through all market environments. This will in turn inform the decision about how large an allocation to the risky asset class—stocks—a portfolio can and should make.

Read More.....

Being in quarantine has provided all of us some time for reflection, introspection, baking and garage cleaning. We return to some of the recurring themes we observe and continue to rail against.

Read More.....

Updates on Tax, Audit, Media and Operations

Read More.....

What do you do when your money management strategy, even one with a multi-decade history of success, sinply is not having a good run? That's the problem facing value investors.

Read More.....