Posted: November 20, 2015 | by: Thomas F. McKeon, CFA

Collecting premium in a sideways market is beautiful thing.

Tweet

Tweet

Today is the monthly option expiration. On or just before expiration each month, we have to roll the hedges on all of our hedged strategies. Modeled on the CBOE hypothetical option-based benchmarks, we use the one-month, at-the-money call option to hedge. The strategy—known as a buy-write or covered call—is options 101.

While the US equity markets rallied sharply since the October expiration, overseas markets did not really participate. Emerging markets have had a rough go this year with concerns about slowing growth and depressed commodity prices. And this is why having some of your equity exposure hedged with a short call at all times makes sense. Not a sometime on, sometimes off approach, but a permanent allocation to a strategic approach.

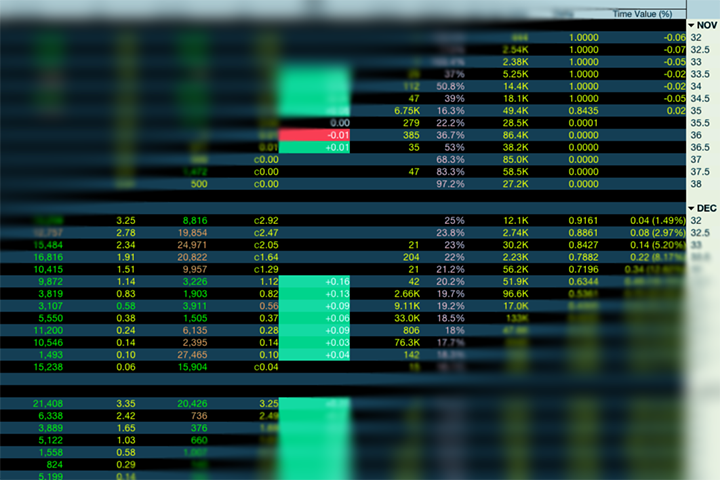

In October, we rolled the hedge on our Emerging Market equity strategy (EEM) to the November 36 strike. Following our protocol, we sold the one-month, at-the-money option….no active decisions involved. Today—again following the protocol—we rolled the option hedge down to the 35.5 strike in December, closing the short November hedge at $.01. The hedge this month delivered a realized gain of 2.3% of the underlying investment in the EEM. That’s 2.3% that unhedged investors did not earn. 2.3% for one month annualizes into nearly 28% annually. Hypothetically, our strategy could earn a 28% annual return while the underlying EEM meandered aimlessly sideways.

We all know that is not how the real world works. In the randomness of short-term market action, the hedge limits participation in strong up-markets, while delivering enhanced returns in all other markets. And since it is virtually impossible to know what the next month holds, maintaining a hedge for some of your equity exposure—at all times—is the optimal approach.